Have you tried searching for a hotel lately on Google? If you have, you’ve probably noticed a host of new Google hotel-related search results. This is thanks to Google Hotel Finder, a new travel tool similar to Google Flights. "Hotel Finder" aggregates all the hotel information you need to plan a trip.

This begs the question: what does this mean for the hotel industry and search?

In this article, we’ll be looking at three crucial aspects of Google Hotel Finder:

- Hotel Finder Ranking Factors

- Hotel Finder Profiles

- Hotel Price Ads

In an industry where hotel bookings are dominated by online travel agents (OTAs) like Expedia or Bookings.com, hotels looking to increase their discoverability through search can leverage Hotel Finder and Google’s Hotel Price Ads (HPA) to start competing with OTAs for online reservations.

Top 5 Hotel Finder Ranking Factors

While still in its early stages, Hotel Finder has recently undergone changes to make it mobile-friendly, affecting some UX aspects and its algorithm. Unlike OTAs that suggest the most popular hotels, Google Hotel Finder tries to find the most relevant hotels using these 5 factors:

1. Number and Quality of Reviews

One of the main factors that Google uses to rank hotels is their reviews. It’s hard to find any hotel with less than 4 out of 5 stars in the top results. When there is some disparity, it usually comes down to either the number of reviews or the number of logged-in reviewers.

Google gives more weight to reviews from logged-in users than to anonymous ones. In fact, the number of Zagat user reviews has almost no impact on hotel rankings.

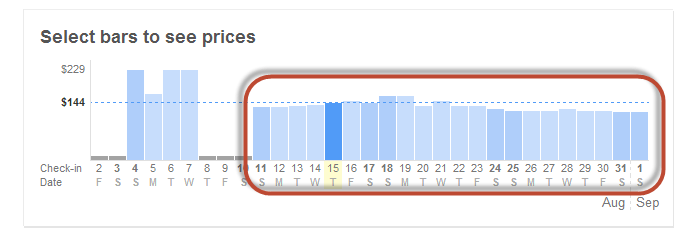

2. Pricing

Hotel pricing is factored in two ways. Google shows a variety of prices at first. However, pricing results will change over time to adjust to your behavior. If you are constantly clicking on cheap hotels, the results will prioritize cheaper hotels.

On the other hand, Google Hotel Finder also ranks hotels that are not overcharging customers. This feature adds accountability to hotels that overcharge their customers during weekends.

3. Presence on Google+ Local

It’s rare for a hotel not to be present in Google+ Local due to Google’s scraping policies. However, Google prioritizes hotels that have taken ownership of their Google+ pages.

4. Quality Pictures

Surprisingly, some hotels lack pictures associated with their account. Adding pictures can boost your position in Hotel Finder and prevent users from getting the impression that they’ll be sleeping on the sidewalk.

5. Proximity to City Center

By default, Hotel Finder begins its search for the perfect hotel from the city center and then slowly spirals out from there.

How Are Profiles Built?

Much like the photos that appear on hotel listings, Google scrapes content that isn’t necessarily from one of their properties. Google is currently scraping hotel descriptions and amenity lists from two sources: Google+ Local listings and websites part of the Northstar Travel Media network.

The data for some hotels shows flaws in Hotel Finder’s information-gathering process. For example, the Molson Center was renamed the Bell Center in 2002, yet some descriptions do not reflect this change. This inconsistency was not present in the non-mobile version of Hotel Finder. Hopefully, this will be fixed, or a better scraping source will be developed.

How Hotel Price Ads Work & How to Join the Big Players

Hotel Price Ads require hotels to work with their Central Reservation System (CRS) and/or a Global Distribution System (GDS) to start using HPA. The main advantage for AdWords users in Hotel Finder is getting priority placement in the Hotel Finder search results.

Getting your hotel a better ranking in Hotel Finder won’t necessarily provide direct ROI, but it provides an alternative to the current OTA booking system. Google will claim a smaller commission than the average OTA by using a similar bidding system as AdWords.

Google SERP and Price Ads

Hotel Price Ads work similarly to AdWords. Hotels and OTAs bid on certain locations and keywords. It is essentially a closed bid war between OTAs and the hotel brand, but with a better ROI than AdWords, especially when Hotel Finder is included. This is due to the comparative nature of Hotel Finder.

Unlike an AdWords ad, users who click on an HPA have likely compared your hotel with others in the region, leading to a much higher conversion rate.

Even with the advantages of HPA, it seems to be relatively underused. Only major chains like Best Western, Hilton, and Marriott are known to be using it. However, many CRS and marketing agencies are developing relationships to offer these services.

Conclusion

Hotel Finder and Hotel Paid Ads are not extremely popular yet, but much like Google+, Hotel Finder is likely to become a rival to popular OTAs. HPAs will finally allow hotels to regain some traction and profits.

Philip Tomlinson of nvi, an iProspect Company, contributed to this post.